Managing Risk: The Importance of Management Consultants in Mitigating Business Risks and Uncertainties

Risk Management Consultant

Risk consultants use their business, finance, and mathematics expertise to help firms seeking to decrease or eliminate risk while performing operational, financial, and technological business processes. They help clients to identify, understand, and manage risks related to daily operations.

Managing risk is paramount for business sustainability. Management consultants play a pivotal role in this process, offering expert guidance to identify, assess, and mitigate risks effectively. Their strategic insight helps businesses navigate uncertainties, anticipate potential challenges, and implement proactive measures to safeguard against adverse impacts. By analyzing market trends, regulatory changes, and competitive pressures, consultants enable organizations to develop tailored risk management strategies. Through their support in implementing robust internal controls, compliance frameworks, and contingency plans, management consultants empower businesses to enhance resilience and capitalize on opportunities for sustainable growth in an ever-evolving business landscape.

Why Risk Management is Key for Business Resilience?

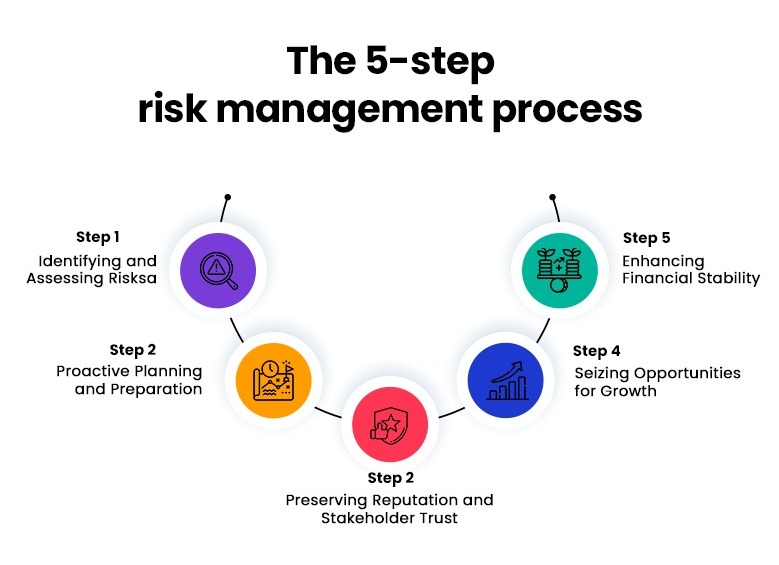

Risk management is essential for ensuring business resilience and long-term success in today’s dynamic and uncertain business environment. Here are several reasons why effective risk management is key for business resilience:

- Identifying and Assessing Risks: Risk management allows businesses to identify and assess potential risks and uncertainties that could impact their operations, finances, reputation, and stakeholders. By understanding the nature and magnitude of risks, organizations can prioritize their mitigation efforts and allocate resources effectively.

- Proactive Planning and Preparation: Through risk management, businesses can proactively plan and prepare for potential disruptions and crises. By developing contingency plans, business continuity strategies, and response protocols, organizations can minimize the impact of adverse events and ensure continuity of operations.

- Preserving Reputation and Stakeholder Trust: Effective risk management helps businesses protect their reputation and maintain the trust and confidence of stakeholders, including customers, investors, employees, and partners. By addressing risks proactively and transparently, organizations demonstrate their commitment to responsible business practices and integrity.

- Seizing Opportunities for Growth: Risk management enables businesses to identify and capitalize on opportunities for growth and innovation while managing associated risks. By taking calculated risks and leveraging market opportunities, organizations can gain a competitive edge and drive sustainable growth.

- Enhancing Financial Stability: Through risk management, businesses can mitigate financial risks, such as market volatility, credit risks, and liquidity challenges. By diversifying investments, hedging against currency fluctuations, and optimizing capital allocation, organizations can enhance their financial stability and resilience to economic downturns.

Overall, risk management is essential for business resilience as it enables organizations to anticipate, adapt to, and mitigate risks effectively, ensuring their long-term viability and success in a rapidly changing business landscape.